House View: October 2022

October 3, 2022Bye-bye Goldilocks

Gone are the days of Goldilocks, when the economy was neither running too hot nor too cold, and fears of deflation outweighing any monetarist ‘inflation scaremongering’. The current regime change after decades of easy monetary policy seems brutal. Or are we witnessing only a temporary bout of price rises, soon to be reined in by central banks raising interest rates to levels last seen before the Great Financial Crisis? This appears to have been the expectation of many financial market participants during the sell-off phases of June and mid-August into September, i.e. starting to discount a deep recession as the consequence of a braking maneuver in monetary policy unseen in decades. We are very doubtful of the notion that inflation will be dispensed with quickly, as the effects of the monetary tightening themselves will feedback into the central banks’ reaction function – the economic slowdown stemming from the interest rate hikes could prove stronger than anticipated by many, undermining the notion to “hike at all costs”. This however is a story for 2023, but for the autumn of 2022 it is important to note that major central banks’ hawkish stance has reached levels unseen in decades. And markets appear to finally have gotten the message, with futures-based rate expectations rising the quickest in half a century.

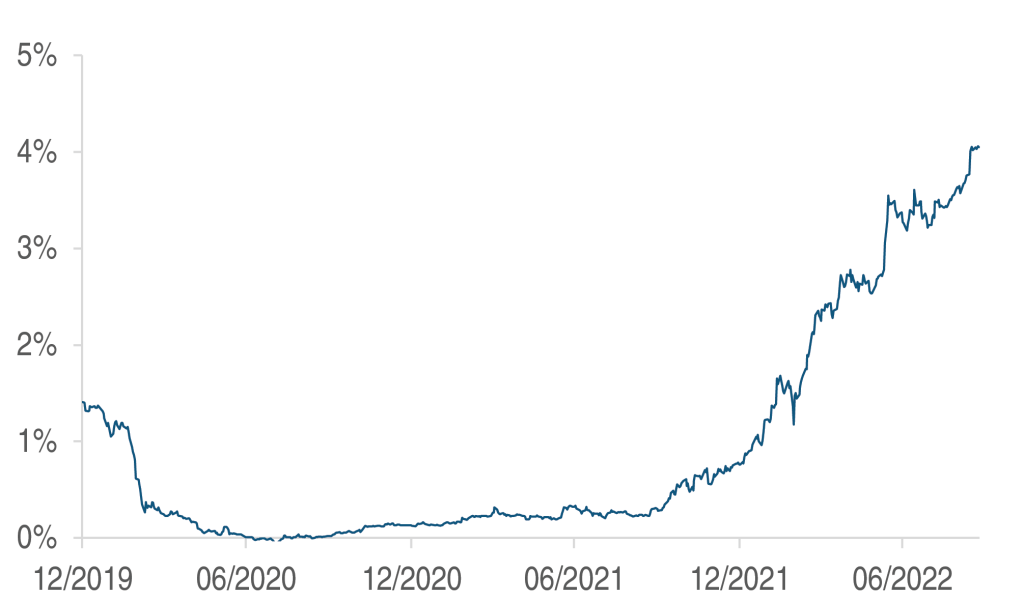

FUTURES-IMPLIED FED FUNDS RATE FOR DECEMBER 2022

While the macro-economic leading indicators are sending mixed signals in the US and globally, market-based gauges are telling a much darker story. Credit spreads are rising, and defensive sectors are outperforming broad indices, a display of investors seeking shelter from the recession risks that are growing with every additional quarter percentage point hike the market prices in. There are however interesting developments to be observed on markets, showing to us how varying and inconsistent the different parts of the market are priced. For instance, the expectation of where inflation will be one year (or five or ten years) from now can be deducted from the difference in pricing between nominal and inflation-protected Treasury securities. Only six months ago, the so-called one-year break-even rate stood at 6.3{65b79214172807242d5f8cbb54acc75262ef12d1d68a01b20791f3528a757539}. By mid-June, it had reached 5.6{65b79214172807242d5f8cbb54acc75262ef12d1d68a01b20791f3528a757539} and in the three months since has dropped to a level of mere 1.9{65b79214172807242d5f8cbb54acc75262ef12d1d68a01b20791f3528a757539}.

Such a movement in short-term inflation expectations appears irrational, especially considering the continuous surprises to the upside in CPI data publications world-wide, however the mood on markets is reflected quite well by this movement: in that recession fears and corresponding strong falls in inflation rates are now being priced in. Interesting to note that the 1-year break-even inflation rate a year ago stood at 2.5{65b79214172807242d5f8cbb54acc75262ef12d1d68a01b20791f3528a757539}, which corresponds to a headline inflation rate in August 2022 of 8.3{65b79214172807242d5f8cbb54acc75262ef12d1d68a01b20791f3528a757539}. Perfect foresight appears not to be a characteristic of TIPS investors.

US 1-YEAR TIPS BREAK-EVEN RATE

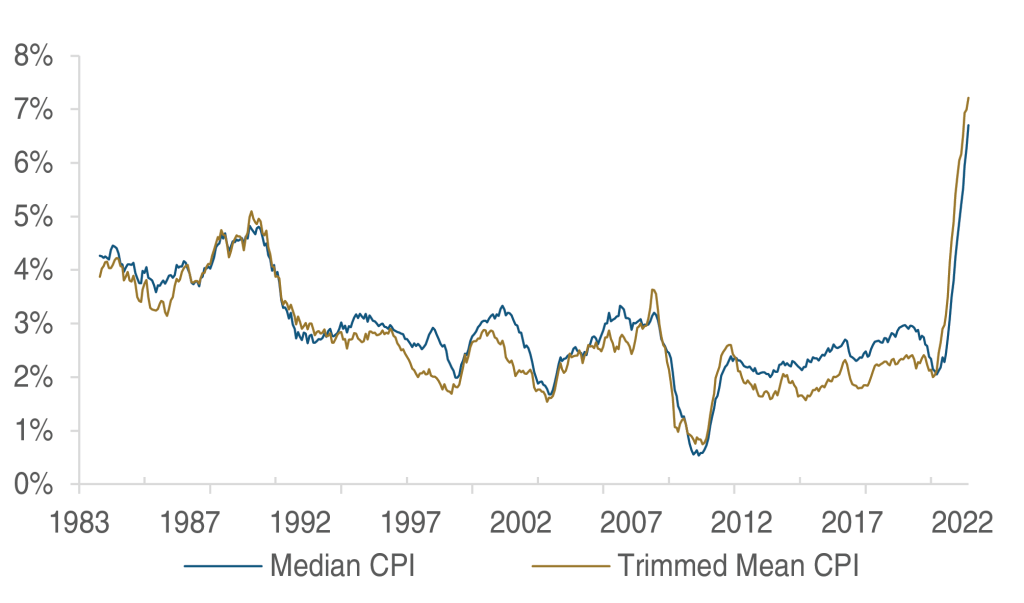

Highest inflation rate in 40 years

Measures were devised to filter out the more erratic parts of the consumer price index, in order to get a smoothed picture of where goods and services prices had been heading. Looking at the median CPI, i.e. the inflation rate of the product group exactly at the center of ranked inflation rates, the level stands at 6.7{65b79214172807242d5f8cbb54acc75262ef12d1d68a01b20791f3528a757539}, the highest level since the index was first calculated some 39 years ago. The previous record growth rate in the median CPI had taken place in 1990 at a level of 4.8{65b79214172807242d5f8cbb54acc75262ef12d1d68a01b20791f3528a757539} – at a Fed Funds Rate of 8{65b79214172807242d5f8cbb54acc75262ef12d1d68a01b20791f3528a757539} in the summer of 1990, a level which today may sound almost absurdly high to someone accustomed to the past twenty years of an average leading rate of less than 1.4{65b79214172807242d5f8cbb54acc75262ef12d1d68a01b20791f3528a757539}.

Different US inflation measures

Now, all is set to change, the Fed is telling us. Even the ECB has started to sound a little hawkish, with it being expected to raise the Deposit Facility to about 2.4{65b79214172807242d5f8cbb54acc75262ef12d1d68a01b20791f3528a757539} from the current 0.75{65b79214172807242d5f8cbb54acc75262ef12d1d68a01b20791f3528a757539} (and to 3.3{65b79214172807242d5f8cbb54acc75262ef12d1d68a01b20791f3528a757539} by end-2023). The Fed signaled this spring it wants to shrink its balance sheet by USD 95bn per month, in effect draining further liquidity from the system, at a time when markets are railing already from the prospect of a complicating geopolitical and economic landscape. We consider the chances of an unintended policy error – in the form of a liquidity crisis, potentially even with the threat of a credit crunch – as significant, with the Bank of England’s enforced intervention in the Gilts market in late September an example of the kind of crisis management that may be increasingly necessary. Alternatively, we would not be overly surprised if the monetary policy course will have to be adjusted before year end, if only cosmetically so. Needless to say, we expect to see more mayhem and losses on markets, before we may expect a toning down of the harsh messages doled out by Jay Powell, Christine Lagarde, and their peers.

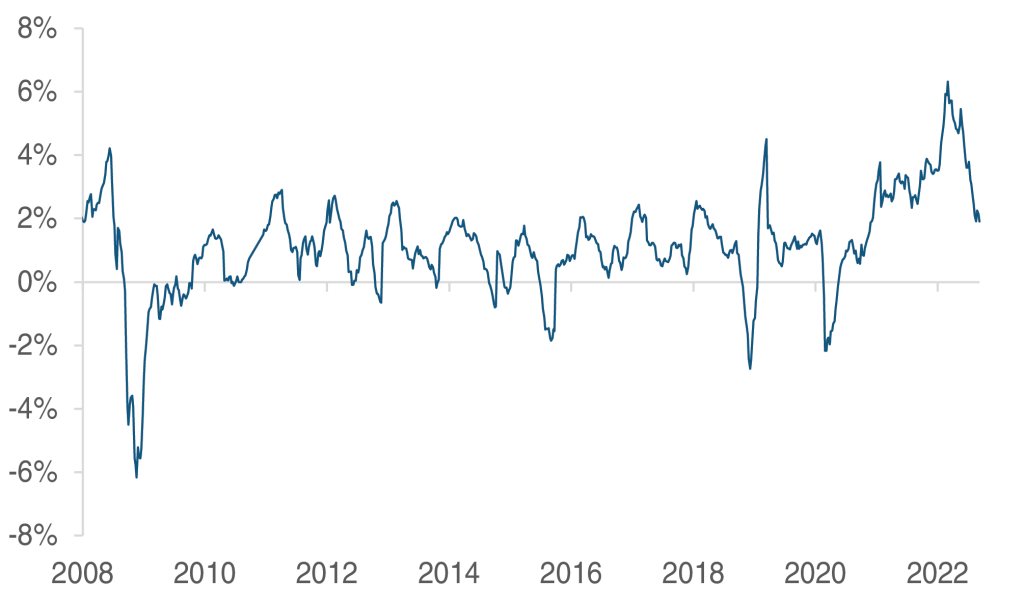

Global corporate bond yield average

Bottom not yet reached

That leaves equity markets vulnerable to further losses, while bond markets are reeling from a continued surge in yields as well as a deterioration in credit quality (considering more difficult economic times ahead), a double whammy, in other words. Commodities markets will see ongoing turbulence, as the underinvestment in exploration will be felt for years out, meaning that supply remains constrained, especially in those metals used heavily in the transition to a less carbon-intensive world, such as copper, lithium, nickel – but also fossil fuels that were deemed not to be needed anymore a very short while ago will remain in consumption for decades to come.

Bloomberg Commodity Energy Index

Energy dependency

Energy prices will remain higher for longer, for several reasons. First, supply is strongly constrained with Russia having shut off its Western European end-markets for a large part. Re-routing is taking place, but in natural gas for instance, existing delivery networks rule out any short-term switch to the east. Sourcing of energy will be diversified in Western Europe over the coming years, but for the coming winter and likely also the next, natural gas supply could remain very tight, and thus energy pricing in general for important producing nations such as Germany. Throughout the world, energy is in short supply. Improving living standards in many corners of the world mean a higher consumption of e.g. air conditioning, with an estimated 800m people only in India lacking access to air conditioned rooms, to give some proportions. Renewable energy is growing strongly also in emerging economies; however demand will continue to rise materially going forward in the coming years. What is more, the switch to green energy and increased electricity consumption due to a move away from internal combustion units and from fossil-fueled heating systems keeps demand well supported for the long run.

How the coming winter will present itself for energy-starved Europe not least depends on how mild the coming cold season will be. The threat of power blackouts in later winter, although remote, is now openly discussed throughout the media landscape; what this means for political developments, remains open. In the short term, the outlook to sit in a dark and cold home for many voters could trigger a strong feeling of protest, strengthening those parties with more radical solutions. In the context of a supranational organization such as the EU, existing wedges could be driven further.

The elections in Italy have propelled Giorgia Meloni’s “Brothers of Italy” to the top spot, with 26{65b79214172807242d5f8cbb54acc75262ef12d1d68a01b20791f3528a757539} of all votes cast in favor of the post-Fascists. Together with its rightist partners, the Northern League and Forza Italia, it will hold a strong majority in parliament, enabling the coalition to push through important reforms. The harmony between the coalition partners is likely to end soon in our view – with the leaders of the League, Salvini, and Forza Italia, Berlusconi, blessed with a heavy profile neurosis and underneath the surface quite some disagreement, e.g. when it comes to how to treat Russia, an important energy supplier to Italy. We do not think the term “Italexit” will surface again in the coming months, as the EUR 200bn earmarked for Italy by the EU’s NextGenerationEU recovery plan will soothe many isolationist’s urges to part with Brussels. In the coming weeks, much hinges on the proposed coalition government members, especially in the domain of finances and foreign policy.

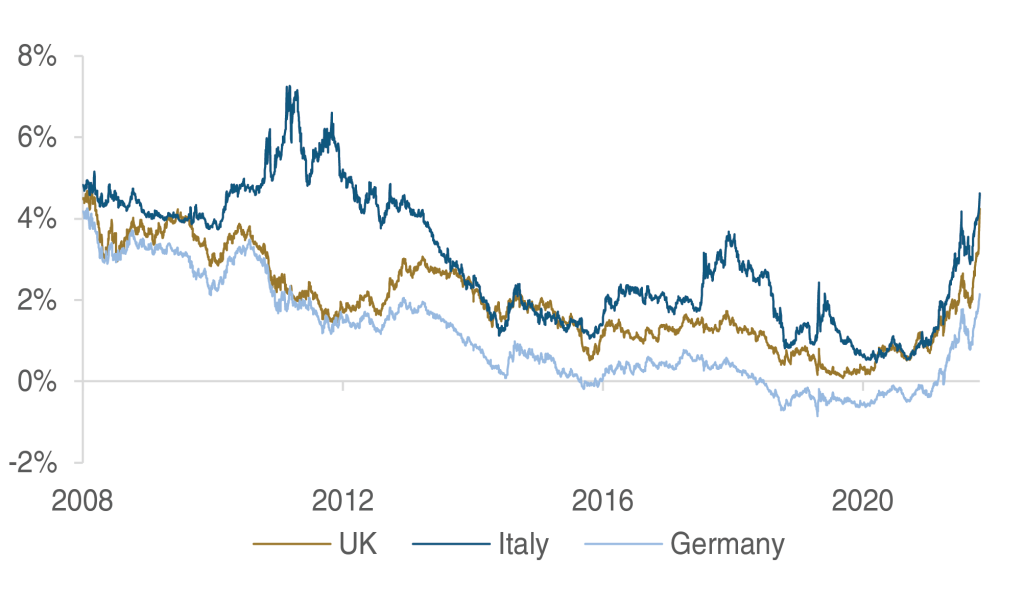

10-year government bond yields: Germany, UK, Italy

Nevertheless, the bond markets have woken up, it appears, with a sell-off in many government bonds. We deem it interesting that 10-year UK Gilts now yield on par with 10-year Italian BTPs, a display of as how good the financial markets consider the quality of prime minister Truss’ economic and financial proposals deemed to be inspired by the economic policy of the Reagan administration of the early 1980s. The fact that the pound has slid by some 15{65b79214172807242d5f8cbb54acc75262ef12d1d68a01b20791f3528a757539} since early August is another display of international investors’ concern about the Truss economic policies.

Difficult macro picture

The macro-economic picture remains difficult for many economies. In the US, the effects of the first hike of only six months ago are slowly starting to be felt. And it was just three months ago when the Fed jolted markets with their three quarter of a percentage point hike, followed by now two more steps of the same hefty size. Therefore, it could be early next year when the tighter monetary policy starts to take its toll on the real economy. We remain very focused on signs of weakening bargaining power on behalf of workers, because if wage growth remains on track of seeing the best gains in decades, the consumer could keep any coming recession from turning into a severe and longer-lasting drawdown.

In Europe, things look bleak. Much hinges on any meaningful gas supply from Russia, at least in many countries in the central area, but also the state of some nuclear power plants in France remains questionable in terms of production capability due to corrosive damages in the cooling circuits. Add still high coal and natural gas prices globally, and the stage is perfectly set for painfully higher living costs for several years to come. The West-dominated global economic system has the ability to adjust to all the current disruptions but adapting to a new set of economic reality – towards a reset of international relations in Europe, Asia and throughout the world – will come at a price that only slowly becomes clearer, namely a prolonged period of elevated rates of inflation with mere weakish growth of the overall economy. That is not an environment in which financial markets thrive, with especially the prospect of tighter funding conditions driving down valuations of private market investments opening the door to a worrisome scenario, with the clogging up of financing avenues for a multi-trillion industry bringing the banking sector into trouble.

EM heterogeneity

The situation in China continues to be difficult, with the zero covid strategy hampering growth meaningfully. What is more, many Western companies are looking for alternative production locations to their Chinese operations, for a plethora of motives such as “friend-shoring” (moving production to countries aligned with the Western home country), adding redundancy to supply chains as well as reducing the dependence on China’s ruling party’s decisions. The demographic shock due to the introduction of the one-child policy in 1980 presents a very difficult task with the Chinese economic planners – as the working population in China has already started to shrink, with an acceleration starting in the second half of this decade.

When will the Fed cave?

To us, the question is when, not if the Fed will change its hawkish stance or at least meaningfully tone it down. The coming CPI prints (usually released just before mid-month) will be instructive, as will be the pace of slowdown in the real economy over the summer. From the experience of previous QT attempts by the Fed, such as in 2012 and 2018-19, the market reacted rather viciously to its punch bowl being taken away from them. Back in 2019, despite decent annualized economic growth in the order of 2{65b79214172807242d5f8cbb54acc75262ef12d1d68a01b20791f3528a757539}, a crisis in the overnight liquidity market forced the central bank to end the reduction of its balance sheet that had amounted to about 15{65b79214172807242d5f8cbb54acc75262ef12d1d68a01b20791f3528a757539} of its previous peak in January 2018. In 2012, this reduction amounted to a mere 4{65b79214172807242d5f8cbb54acc75262ef12d1d68a01b20791f3528a757539} and was stopped by the European debt crisis as the global financial system once again stood by the abyss.

How high are the odds that the announced pace of almost USD 50bn of monthly tightening for the first three months (June-August) and of USD 95bn monthly thereafter will not be met? We would not be overly surprised that we will see quite soon a modification of the plan that had originally been published at the FOMC’s May 2022 meeting.

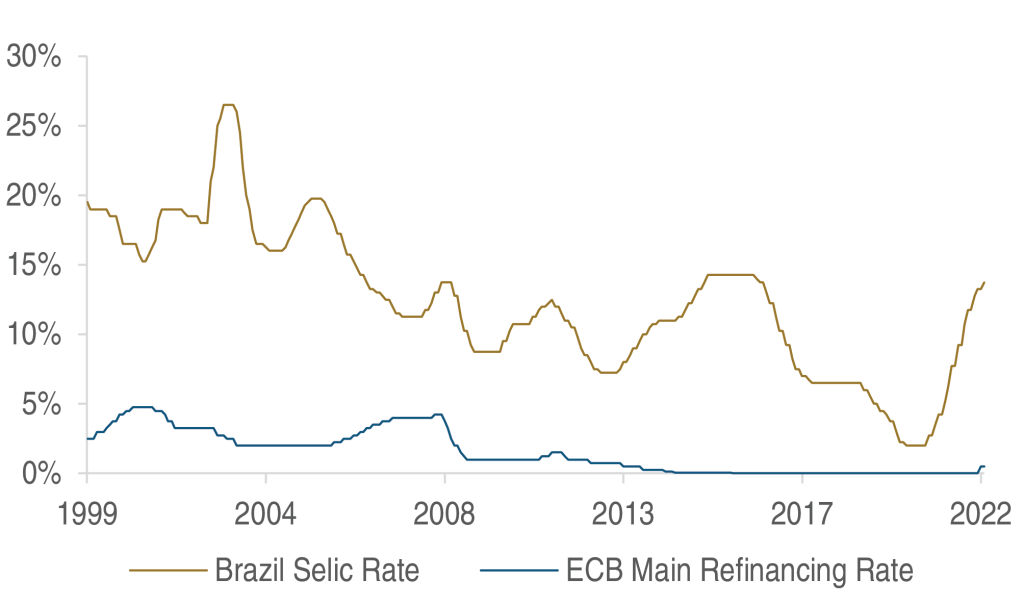

Brazil and Eurozone central bank rates

Several emerging market countries are blessed with a broad endowment of commodities, be it resources in the ground or fertile soil to produce agricultural goods. Regionally, Latin America fits this description. Based on our expectation of “brick and mortar” goods to be in short supply for the longer term, adding exposure to these countries, both in equities and fixed income, should prove advantageous for investors. The yield difference between the Brazilian leading interest rate SELIC and the ECB’s deposit facility rate stood at a good 2{65b79214172807242d5f8cbb54acc75262ef12d1d68a01b20791f3528a757539} at the height of the pandemic, today has reached 13{65b79214172807242d5f8cbb54acc75262ef12d1d68a01b20791f3528a757539} (check). In the past, dramatically higher interest rates in Brazil compared to the Eurozone were the result of the stark differences in inflation rates. Today, the two economies display a very similar level around 9{65b79214172807242d5f8cbb54acc75262ef12d1d68a01b20791f3528a757539}. The current presidential elections show that democracy functions rather well in the largest country of the continent, despite the turmoil and the accusations of “stolen elections” that are making the rounds after the first round.

To intervene or not to intervene?

Much hinges on the future development of global currencies. The US dollar profits from the Fed‘s role of spearheading the Western central banks in terms of rate hikes. The yen dropped even more than the euro against the dollar, as the Bank of Japan stubbornly keeps its leading rates at -0.10{65b79214172807242d5f8cbb54acc75262ef12d1d68a01b20791f3528a757539}. Based on market expectations, the yield pickup from the yen to the dollar amounts to 4{65b79214172807242d5f8cbb54acc75262ef12d1d68a01b20791f3528a757539} in December, luring large amounts of international capital into the carry trade. After a steep drop in yen/dollar this year, the Japanese central bank announced it was intervening to prop its currency up, leading to yet only a mute countermove. Whether it will be more successful going forward is also dependent on other central banks joining the fx market interventions, most notably the Fed which could offer USD swap lines to other central banks – as it did during the GFC. Only few countries can boast of a currency that is well supported by economic fundamentals, among them European smaller states such as Switzerland which enjoys a relatively low inflation rate of between 3 and 4{65b79214172807242d5f8cbb54acc75262ef12d1d68a01b20791f3528a757539}, thanks to the strengthening Swiss franc depressing import prices. With the Swiss National Bank (SNB) having built a track record of steady and independent economic policy plus the beneficial economic factors working as a tail wind, the franc will remain strong for the foreseeable future with the risks clearly leaning to a further revaluation.

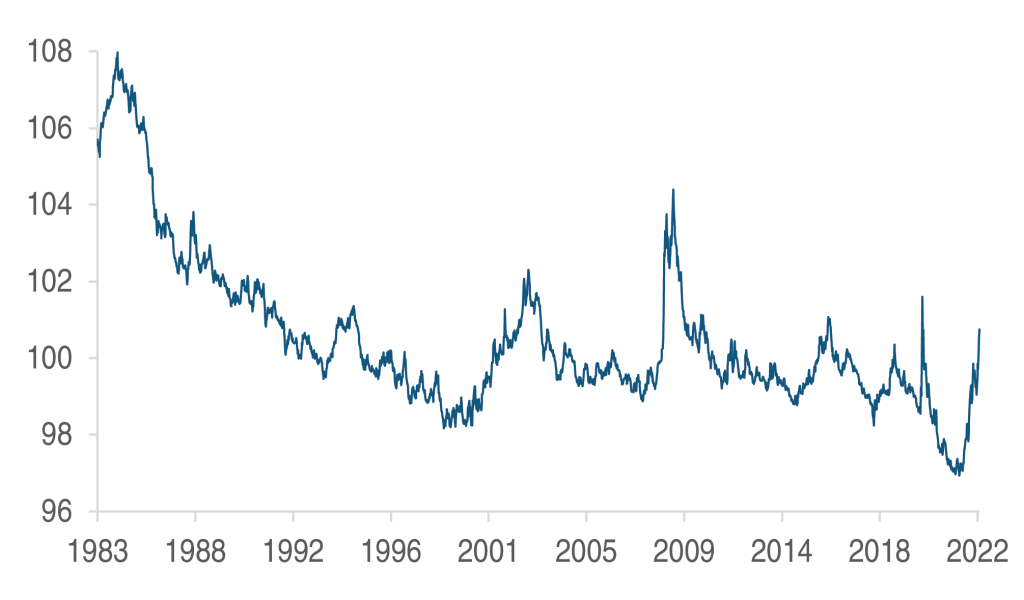

GS US Financial Conditions Index

Financial conditions are tightening at a very high velocity globally, with liquidity markets starting to emit signals of stress. We are monitoring the Ted (Treasury-Eurodollar) Spread closely, as its widening further would indicate growing funding stress in the banking sector. Central banks at one point will have to tackle any doubts about the viability of the financial system – the perspective of other global powers only too gleefully watching (and helping) economic meltdown in „the Free World“ makes for sufficient grounds for intense political influence on nominally independent central banks, we would add.

Financial conditions in the early 1980s were very tight, as back then, Fed chairman Paul Volcker cured the US economy from double-digit inflation by applying very tight monetary policy. Comparing those levels to today’s, we consider it obvious that the current degree of financial conditions tightness is not sufficient to drive the price pressures out of the system. We must brace for further headwinds from monetary policy in the years ahead.

Conclusion

- With the increasing turmoil taking place on global financial markets, the similarities to the events of 2008 are growing eerily.

We continue to be cautious in our investment strategy for a number of factors could further worsen the outlook for financial markets. - While surprises may come on many fronts, the pressure on central banks will grow with a further deterioration in economic data, but also on the fiscal front we are likely to see more government spending.

- With monetary stimulus taken away and fiscal stimulus (mainly in Europe) being added, the two levers are currently offsetting each other. Especially the announced measures to shield European consumers from an energy price shock make little sense from an economic perspective, as price incentives to reduce demand are being muted.

- The geopolitical sphere will remain influential and with a likelihood of a strong economic setback in Europe due to energy shortages, the outlook is bleak for the Old Continent. But also in East Asia and the Middle East, there are conflicts brewing that may have strong external impact.

- We are afraid of the shrinking of the Fed balance sheet, coming exactly at a time where the world is short US dollars and suffering increasingly by the strengthening greenback.

- A potential relief could come at the admission by the Fed that the pace will have to be reduced, as we are convinced that following the avenue of reducing the balance sheet size by USD 95bn a month at this time of global US dollar shortage and severely tightening of financial conditions is doomed to produce further mayhem on financial markets.

DISCLAIMER: This document is intended for marketing purposes.

Download as pdf.